UBM releases a study of the embedded market every year, by surveying over 1,000 embedded professional every year. They’ve just published their 2013 Embedded Market Study (85 pages report), after surveying over 2,000 engineers and managers, so let’s see whether anything has evolved in the software development and processor space compared to 2012.

Again this year, most respondents are based in the US (62%), followed by Europe (20%), and Asia (12%).

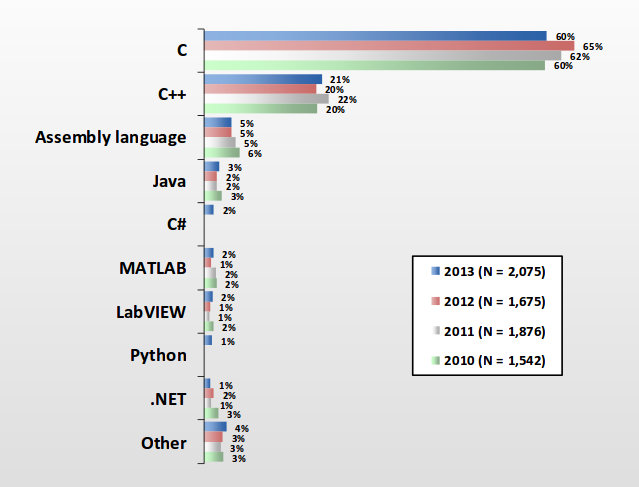

C/C++ languages still rule the embedded world with 81% market share, although a little less than last year (85%), assembler is a distant third (5%).

Interestingly, the average size of development teams seems to have shrunk from 15.9 in 2012 to 14.6 in 2013, the average project being composed of 4 software engineers, 2.9 hardware engineers, 2.7 firmware engineers, 2 QA/Test engineers, 1.5 system integrators, and 1.5 with other functions.

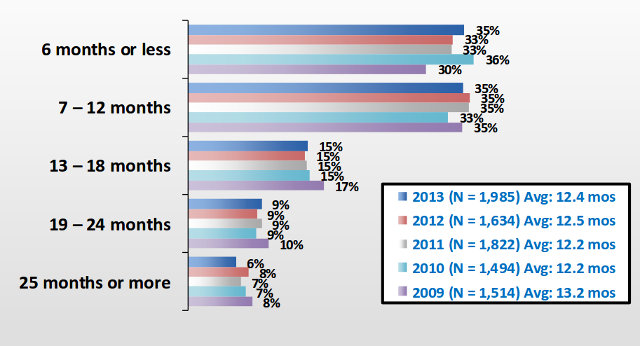

About a third of project last less than 6 months, another between 6-month and a year, and the last third over a year, with project lasting 12.5 months on average.

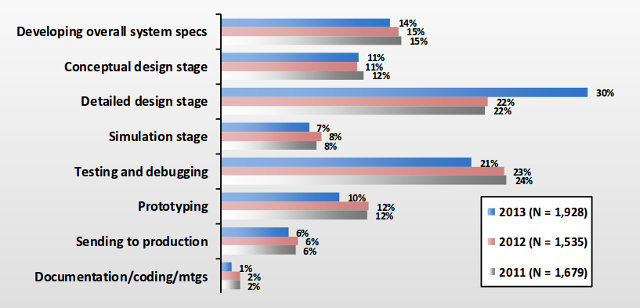

Projects life cycle breakdown shows much more time is spent detailed design stage, and a bit less on testing and debugging. Another interesting point is that only 1% of the time is now spent on documentation, so either people gives even less of a damn about documentation than the previous years, or everybody has become highly efficient at writing docs.

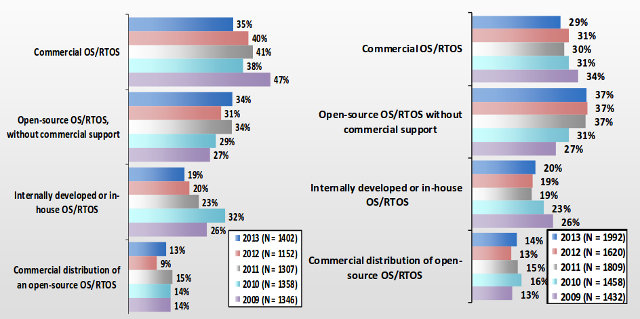

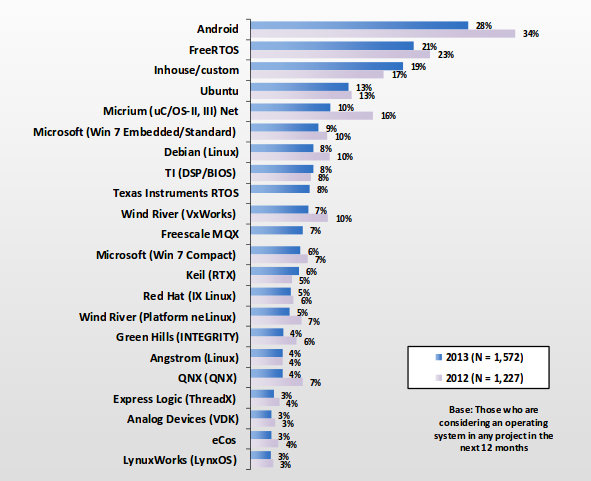

The trends continues, as less and less Embedded projects use commercial operating systems, and companies opt more and more for open source operating systems, and in 2013, the survey shows that most projects are likely to use an open-source OS without commercial support. The top 3 reasons for choosing a commercial OS is real-time capability, good software tools, and processor & hardware compatibility.

AS with previous years, the operating system choice is mainly influenced by software engineering staff & managers (62%), but it’s still sometimes decided by corporate management (17%). The top three reasons for OS selection are a little different from last year, as real-time performance, although still important (29%), has been kicked out:

- Full source code availability (42% in 2013 vs 41% in 2012)

- Availability of tech support (34% in 2013 vs 30% in 2012)

- No royalties (30% in 2013 vs 31% in 2012).

54% of respondents are currently using or consider using embedded Linux in their next project because it is low cost (66%) and easily adaptable and extensible (52%), but 47%, a bit more than last year, would not consider embedded Linux mainly because they don’t need it (72%), but also because of software/app/driver incompatibility (18%) and performance/real-time capabilities (15%). Legal reasons seem to have become less important, as only 6% consider it an issue with embedded Linux, compared to 14% last year.

The enthusiasm for Android in embedded systems seems to have faded a bit compared to last year (28% vs 34%), FreeRTOS is still very much used, and 19% companies still rely only their own OS. Micrium and QNX have declined the most compared to last year.

Overall there has been very little changes and Linux share, including Android, is still strong with about 60%, compared to last year 70%. I’m a bit confused with the chart above, as most OS seem to be stable, or have lost market share, but only In-house OS and Keil have gained slightly.

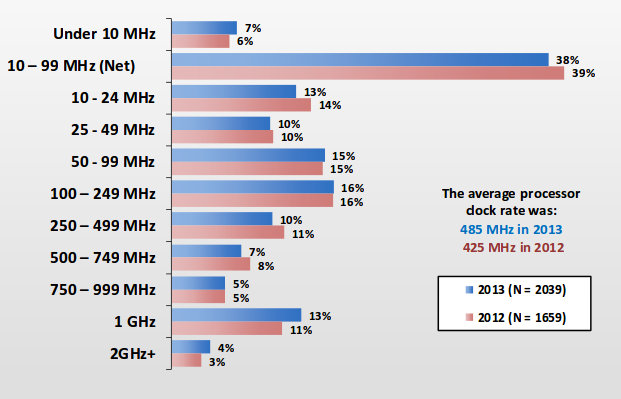

Most embedded projects still use 32-bit processors (63%), followed by 14% using 16-bit version, 12% 8-bit and 8% for 64-bit. Both 8-bit and and 16-bit usage is declining, 32-bit usage is stable compared to last year, and 64-bit usage is on the rise. Most embedded projects still have a main processor clock rate below 250 MHz, the average frequency is creeping up (485 MHz in 2013 vs 425 Mhz in 2012), and 1 and 2+ GHz processors are on the rise.

When asked to cite one and only one vendor with the best ecosystem for the needs of the respondent, Texas Instruments still gets the lead (19%), followed by Freescale (12%) and Microchip (10%) in just the same order as last year.

According to the points above in UBM survey, there hasn’t been drastic changes between 2012 and 2013, but there are still some long and slow trends over several years, such as the increased share of open source operating systems, and the predominance of 32-bit processors.

Jean-Luc started CNX Software in 2010 as a part-time endeavor, before quitting his job as a software engineering manager, and starting to write daily news, and reviews full time later in 2011.

Support CNX Software! Donate via cryptocurrencies, become a Patron on Patreon, or purchase goods on Amazon or Aliexpress

Perhaps you could explain why the os popularity is so different from distrowatch rating. First time i have ever heard of for example freertos

@Sum fool

Sure, it’s a completely different survey. It looks like distrowatch monitors desktop/server OS usage, but UBM survey is about embedded systems, including real-time operating systems running on microcontrollers. For example, FreeRTOS also runs on 8-bit and 16-bit MCU, with kilobytes of RAM and flash.